The BolehPayz app provides services such as E-wallet, Remittance and many more which users can use to facilitate their daily lives.

The minimum requirements to use the BolehPayz app include:

• Android device minimal support Android 7 and above

• iPhone device minimal support iOS 13 and above.

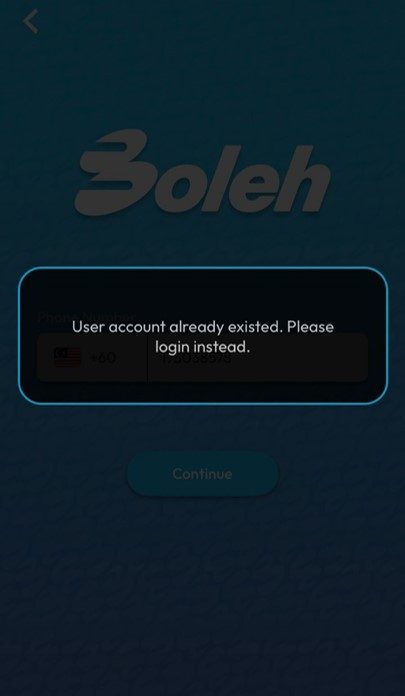

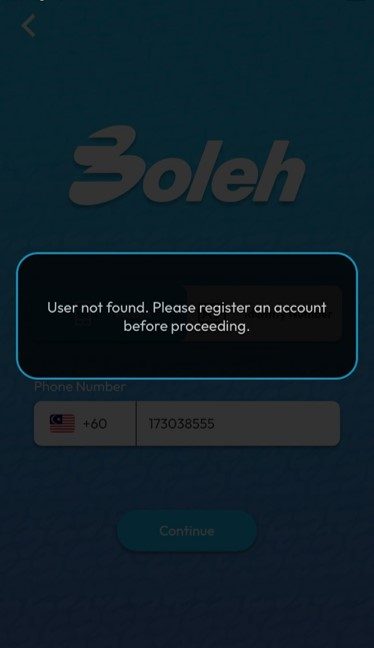

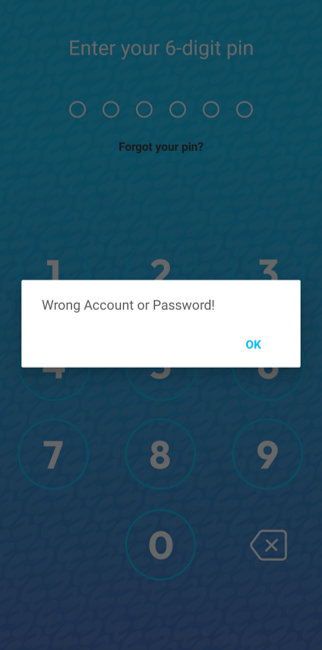

Make sure to key in the correct number or create a new account.

Employers and employees (foreign workers) work in Malaysia, aged 18 and above with valid passport (foreign workers) and work permit.

Original Identity Card (IC) for Malaysians - Employer

User to Email [email protected] with detailed Name, Phone Number, android or iOS version and model phone.

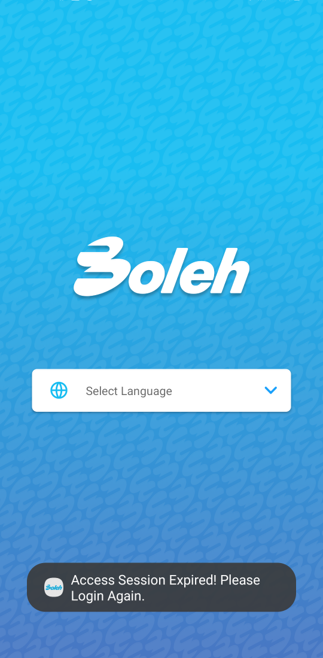

Users need to log in again to the BolehPayz app.

Make sure your data internet is active and stable, and try restarting your phone.

If this still happens you can email [email protected]

Yes, you can, just download the BolehPayz with the new device and log in with the requested OTP.

Click “Forgot your pin?” and check the SMS from BolehPayz for OTP, copy the OTP given and paste it into the BolehPayz App.

Email [email protected] with details:

Name, Phone Number and please attach MyKad or Passport Photocopy.

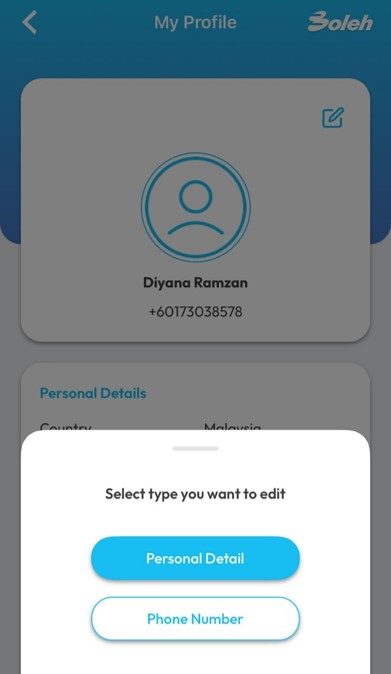

Yes, you can, follow the step below;

Step 1: Click on the “Profile” icon on the bottom right of the homepage.

Step 2: Click the Edit Icon Choose "edit phone number" and enter the new phone number.

Answer the Security Question and OTP received in the new phone number.

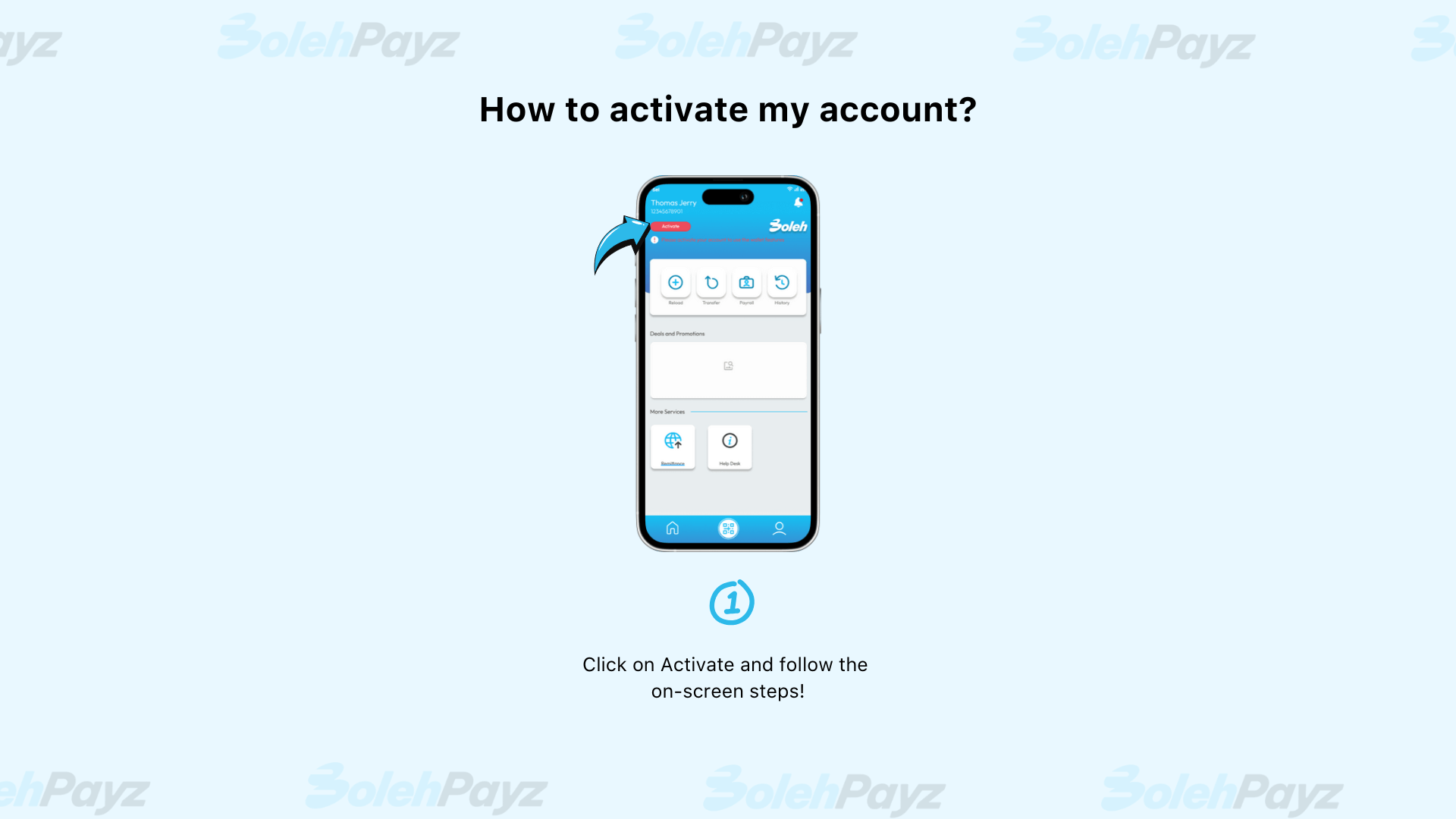

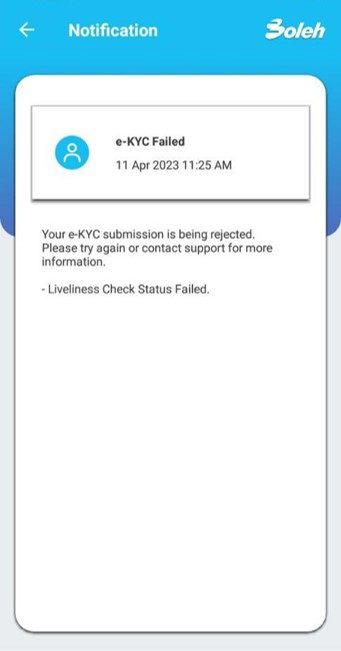

Electronic Know Your Customer is mandatory since it is a regulatory requirement in accordance with BNM guidelines on AML/CFT. Yes, it is mandatory if users want to enjoy the full functions of BolehPayz (i.e., funds transfer).

You can activate your account by tapping on ‘Activate’ on the main page of the app. You need to capture your ID (MyKad or Passport) and also perform a liveness check.

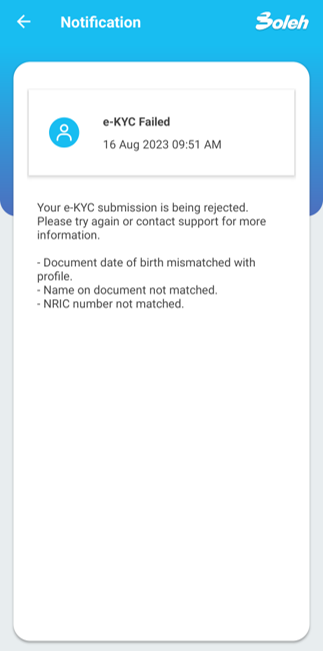

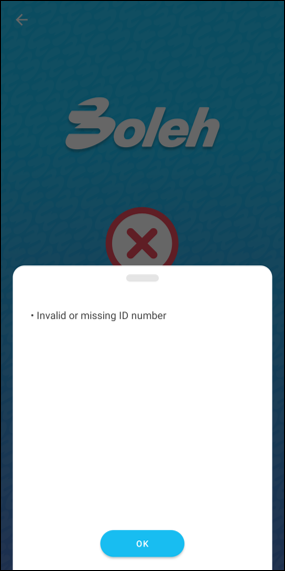

Refer to the red line and the user needs to go back to the profile and update personal information based on the document ID or passport.

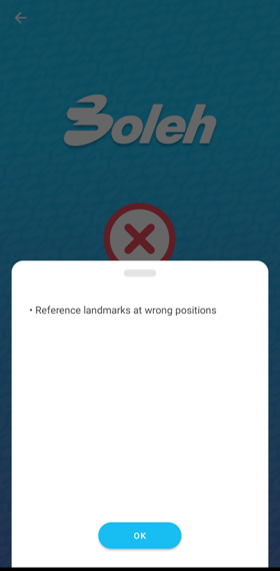

• Make sure you are the same person who is doing the e-KYC.

• Original documents are presented and not photocopied.

• Do not use a passport photo.

• Make sure the environment is bright and clear.

• Make sure your face is within the frame

Make sure your document MyKad and Passport are captured clearly and not damaged or covered with fingers.

Make sure your document MyKad and Passport are captured clearly and not damaged or covered with fingers.

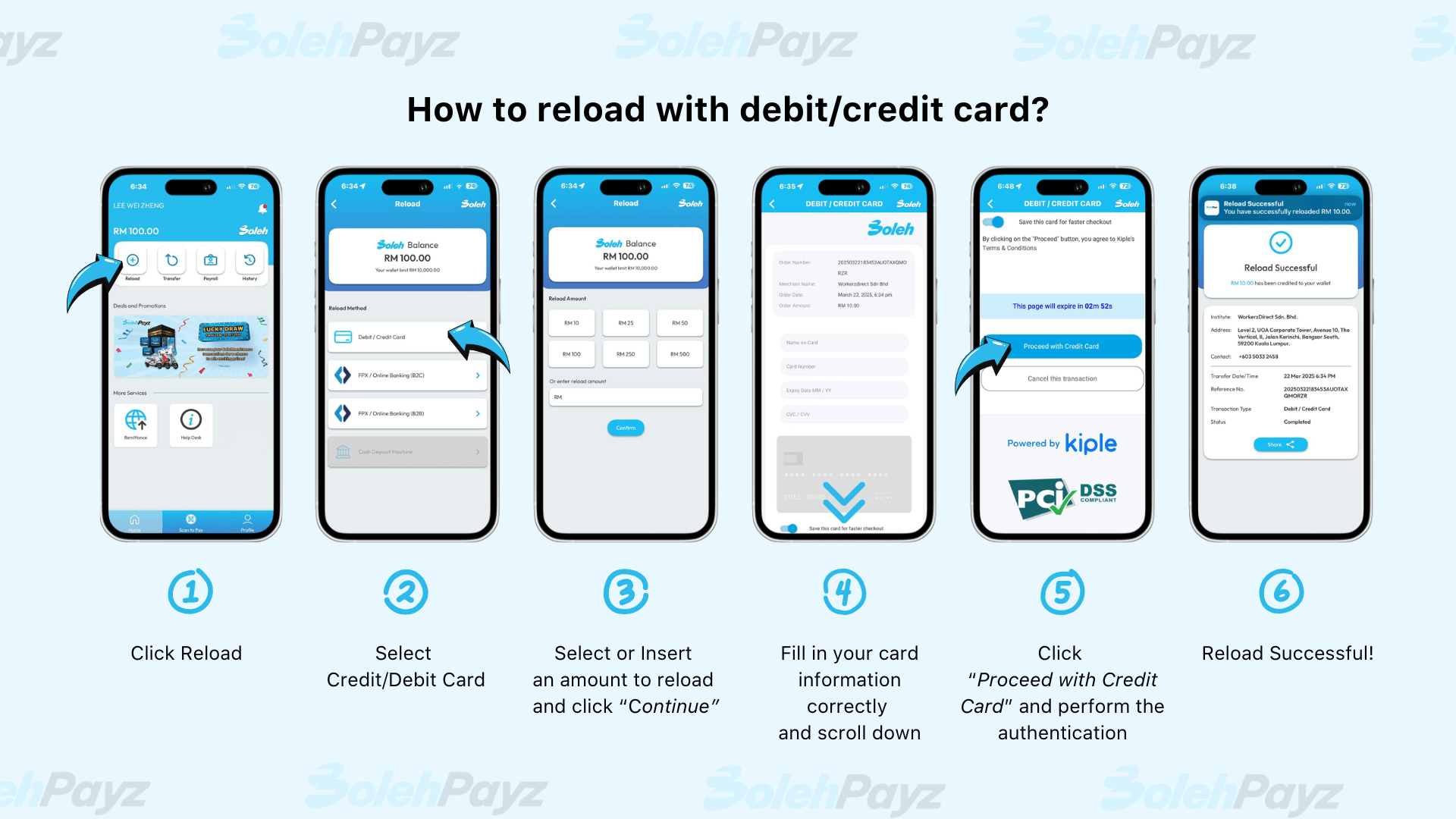

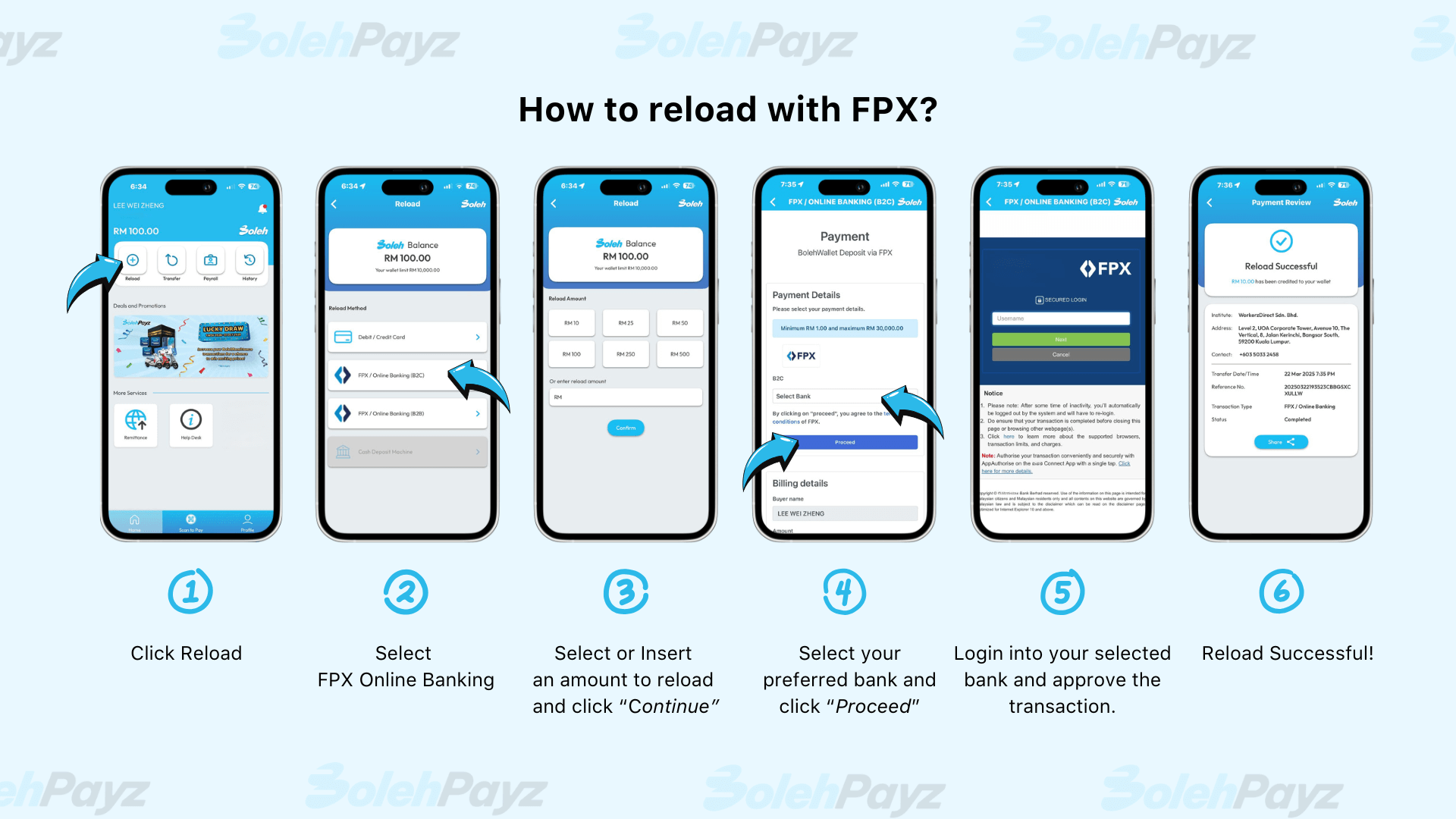

You can reload your BolehPayz eWallet account via online banking only (FPX).

The minimum reload for eWallet is RM 2.

The maximum reload for eWallet is RM 10,000.

No, all transactions performed via the BolehPayz eWallet are in Malaysian Ringgit only.

Kindly verify if the reloaded amount has been deducted from your credit card, debit card, or bank account.

• If the deduction has been made successfully, please keep a close eye on your eWallet balance for the next 3 business days as we will initiate a manual reload adjustment to your eWallet account.

• If the reloaded amount does not appear in your eWallet account within the provided timeline above, kindly contact us by submitting the E-form provided in the Help desk.

Your wallet reload may be unsuccessful due to the following reason: -

1. Error message 'Service Not Available’

This could be due to an issue with the network connectivity or system downtime.

Please try to unbind and rebind your bank card.

2. You have entered an incorrect OTP

Please resend OTP and try again.

3. Your bank card has expired

Please proceed with another bank card or a valid bank card.

4. The bank card is not supported

Only credit/debit cards are issued by Malaysia local banks.

Only AMEX, MasterCard, and Visa are accepted.

5. Device Issue

Kindly do self-troubleshoot to check line connectivity as per below:

4. The bank card is not supported

a) Launch the internet browser, type www.google.com and tap Go.

b) If the page fails to load, you may have internet connectivity issues

6. Internet connection issue

i) Ensure the device is not jailbroken or rooted.

ii) Uninstall and re-install App

iii) Update the app to the latest version

iv) Clear Cache/Data/Storage on your device

If all the above does not resolve your issue, please contact us by submitting a request at [email protected]. Please provide a relevant screenshot to support our investigation.

7. Reload amount not reflected

Issue to be resolved within working hours only. If the reload amount is still not reflected in the Boleh wallet after 15 minutes, user to contact CS immediately.

Remittance is a type of service where you can send money or make a payment to a third party in a different location or another country. Remittance services in BolehPayz include making an international money transfer from Malaysia to another country.

The BolehPayz service is available Monday to Sunday (24/7) Unless there is system maintenance at WorkerzDirect Sdn Bhd, or receiving bank and transactions flagged for compliance review. Terms & conditions applied.

The remittance transaction limit is 3 times daily and not exceeding the balance limit of RM 3,000 (foreign worker only).

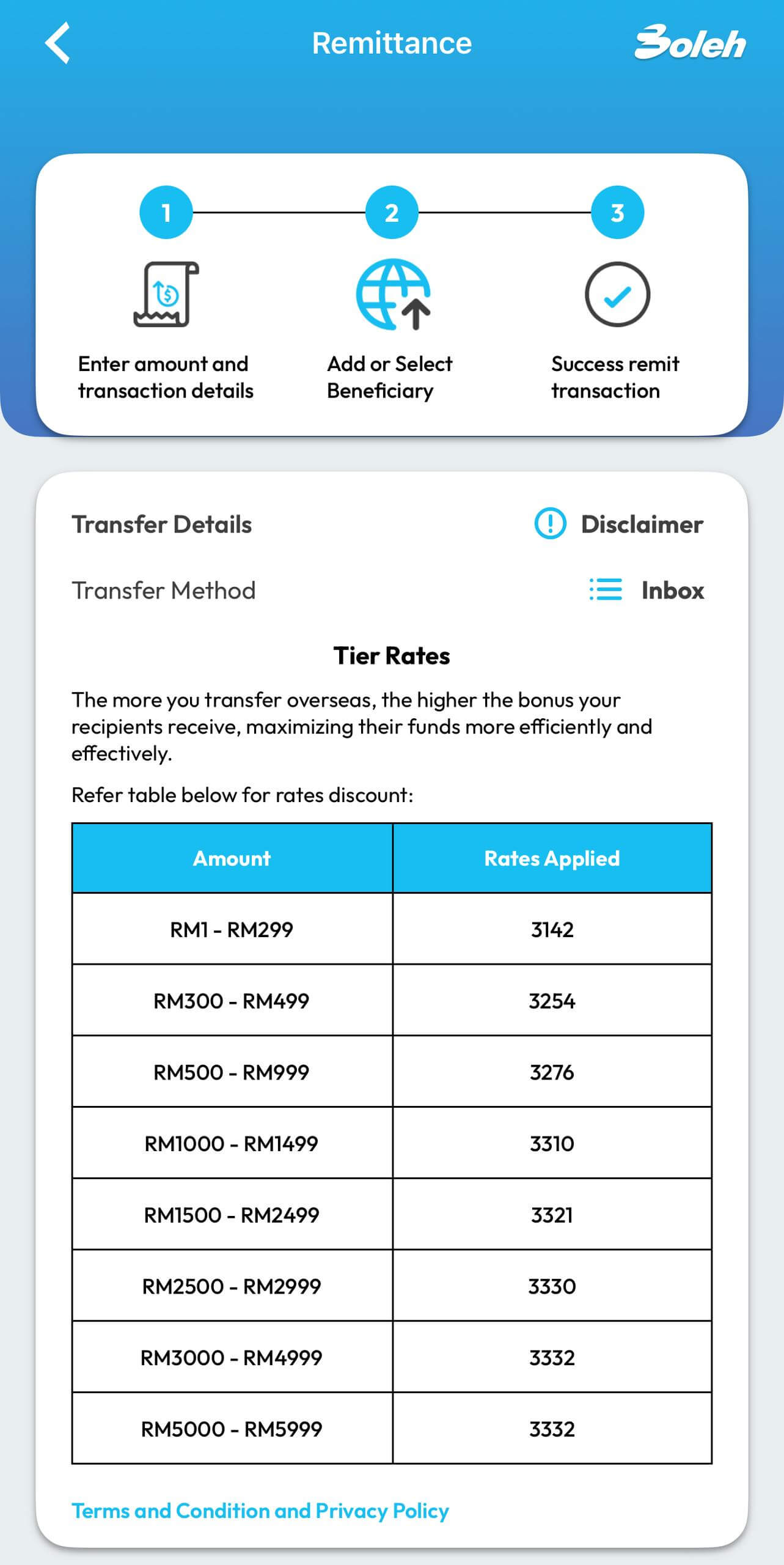

The rate is located within the remittance feature of the application.

The sender will only be charged a low service fee of RM4 per transaction. There would not be any additional agent/beneficiary bank fees charged to the sender or beneficiary.

Transactions will be credited on a real-time basis. 1 Working Day depending on correspondent bank.

You may request a refund/ stop transaction based on the situations below;

• If the correspondent bank has not yet processed the fund, then we can proceed to refund/stop the transaction within 3 working days.

• If the fund has already been credited to the correspondent bank, the refund will take 7-14 days. Additional charges will be imposed based on the correspondent bank charges.

Information of the beneficiary varies across countries as to adhere to the regulations of money transfer.

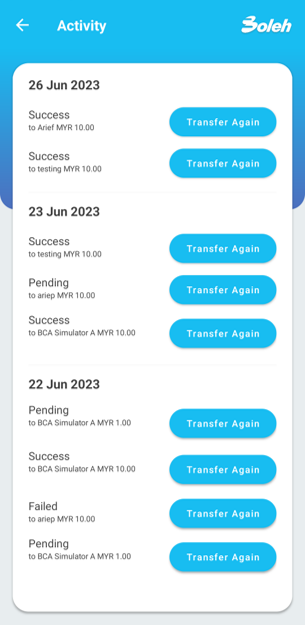

• Log in to BolehPayz App > Remittance

• Click on the activity to view transaction details

• Pending – The transaction is on hold or pending to be credited into the beneficiary’s account.

• Success – Transaction successfully paid/credited to the account

No, cash refund provided – only through BolehPayz wallet or other bank account if account is terminated/closed.

No, you will be refunded based on the bank’s prevailing foreign exchange buy rate. The transaction fee charged during the initial transaction will not be refunded.

Please note that processing the refund will require action from distributing partners and will liaise with them if the money has already been disbursed then such refund will no longer be applicable.

No. you cannot amend the transaction. However, you are able to perform a cancellation.

Cash payout transaction cancellation:

If you wish to cancel the transaction for a cash payout, which has yet to be collected by the beneficiary, then you are allowed to request for refund.

Account crediting transaction cancellation:

If the cancellation is for account crediting, you are not allowed to request for refund if the fund has been credited. In addition, the fee paid will not be refunded to the customer.

Payment mode – eWallet

Type of Payment Accepted- B2C (business to consumer) and B2B (business-to-business)

Disbursement Currency- Indonesia Rupiah

Validation / Verification- Payment will be credited based on a valid bank / eWallet account, and mobile number only

Amount Received- Beneficiary receives a net amount as specified by sending party.

Adult content, Cryptocurrencies, Gambling, terrorism financing, B2B transaction, and sending funds to a non-individual account. Any funds/transactions originating from Israel, North Korea, and Iran.

1. Identification documents (e.g. national ID, passport, and other IDs issued by government agencies)

2. Valid working visa.

3. Financial documents (e.g. salary slip, payment voucher, bank statement, saving passbook, etc.)

4. Case-by-case basis. Customers will be informed via email, notifications sent through the app, and phone calls by CS.

Yes, you can terminate your BolehPayz eWallet account by submitting your request via in-app.

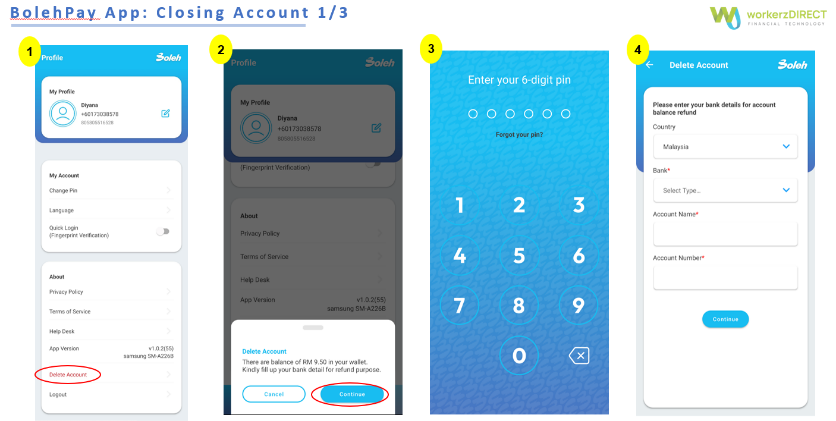

Hereby are steps to terminate your BolehPayz account:

Step 1:Tap on Profile

Step 2:Tap on Delete Account

Step 3:Enter the 6-digit PIN

Step 4:Enter your bank details for account balance refund

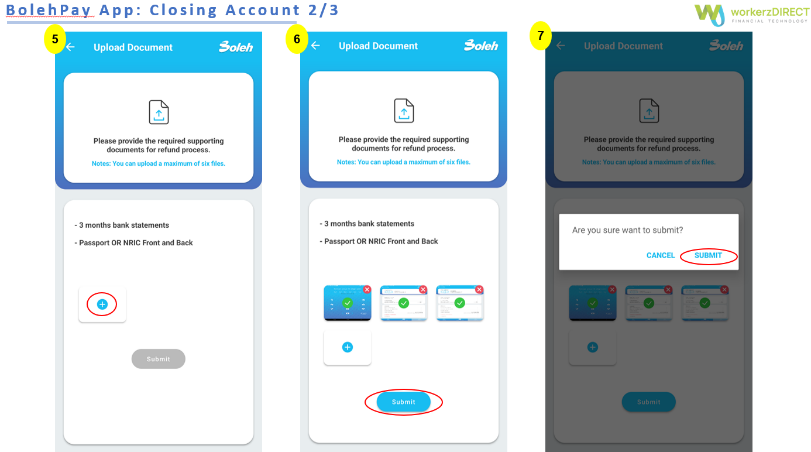

Step 5:Upload your 3 months' bank statements and Passport and NRIC Front and Back

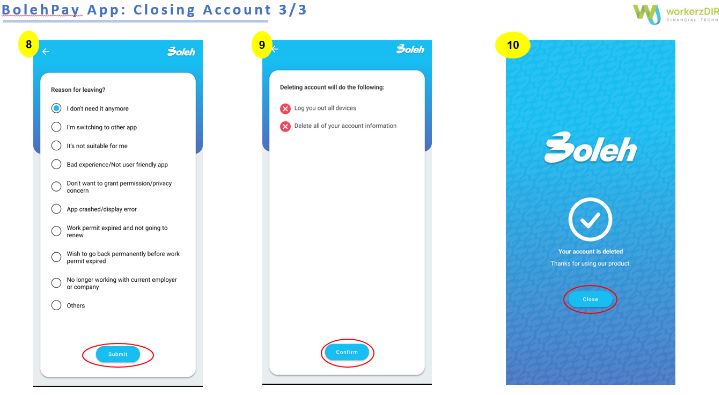

Step 6:Choose your reason for leaving

Step 7:Click 'Confirm' to delete the account

Refunds will be automatically issued after the transfer is canceled if you paid for the transfer with a bank account or card. The refund will return back to the original payment source.

The balance will be refunded to your bank account in the following

| Category | SLA | Refund Mode |

|---|---|---|

| Account Termination | 14 days | Refund into customer's bank account |

| Adjustment unsuccessful reload | 7-14 Working days | Refund into customer's bank account |